- Web

- Humsa

- Videos

- Forum

- Q2A

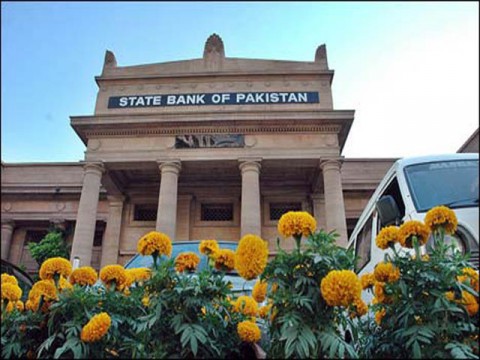

Pakistan’s economy witnessed a modest improvement in FY12 – real GDP grew by 3.7 percent during the year, compared with 3.0 percent in FY11, says the State Bank’s Annual Report on the State of the Economy for the year 2011-12 released on Wednesday.It said the actual outcome in the external sector in FY12 was better: a current account deficit of $4.6 billion and an overall gap of $3.3 billion, meant that Pakistan’s reserves fell by $4.0 billion, against an initial projection of $4.4 billion. ‘Nevertheless, this contributed to a 9.1 percent depreciation of the Rupee during the course of the year. The Rupee depreciated from November to late December 2011, and sharply so in the last week of May 2012.

The first event may have been triggered by the closure of NATO supply routes to Afghanistan, and sustained by rising oil prices; the second adjustment was a brief market panic in response to international developments. In effect, the Rupee was impacted more by one-off events than the underlying economic fundamentals,’ the Report added.

According to the Report, the Pakistan economy will grow at about the same rate in FY13 as it did last year (FY12). ‘We are confident that milder flooding this year and the underlying factors that allowed for 3.7 percent growth in FY12 will largely remain in play,’ the Report added. The Report observed that the structural problems in the energy sector, PSEs and the fiscal side, may not be tackled in the near-term. However, since the government paid-off the accumulated subsidies in FY12, we do not expect the same level of fiscal pressure this year. ‘While the government hopes to achieve a fiscal deficit target of 4.7 percent of GDP, we think a range of 6–7 percent is more realistic,’ the Report added.

According to the Report, a key concern for the central bank is the on-going decline in domestic investment. Although the investment environment in Pakistan is likely to remain challenging, we believe the recent 250 bps cut in the benchmark interest rate, could revive private investment and provide some relief to commercial enterprises.Since the size of the fiscal deficit last year was mainly due to one-off factors, we are hoping things will be better this year, the Report said, adding: ‘We are also optimistic that with the opening of NATO supply routes, Coalition Support Fund (CSF) will be realised in a timely manner. SBP remains hopeful that inflows from privatisation (Etisalaat) and the 3G licences will also be realised in FY13’.

The State Bank Report stressed upon the urgent need to embark on structural reforms in the energy sector, PSEs and public finances. ‘This, together with a more balanced deficit financing mix in FY13, would ease a great deal of pressure from domestic sources of financing – especially the commercial banks,’ the Report added.NNI adds: The demand side was more insightful, as the growth in FY12 was primarily driven by private consumption, it said, adding that strong worker remittances, a vibrant informal economy and higher fiscal spending, supported consumption growth during the year.

SBP Report said that food prices have remained relatively stable during FY12, which helped bring down overall inflation to 11.1 percent - better than the 12.0 percent projected earlier.While services continued to support the economy, commodity producing sectors (agriculture and industry) posted an improvement over FY11, the Report said, adding that the growth in agriculture came from livestock and kharif crops, but minor crops witnessed a decline due to the floods in Q1-FY12.

It said the positive spillovers from agriculture, coupled with strong remittances and income support schemes, boosted construction activities and household consumption - both of which helped the manufacturing sector. In making our interest rate decisions, SBP looks closely at the likely impact on the FX market. One must note that the FX market's reaction to the discount rate cuts in August and October 2012 was quite muted, the Report said, adding that in late November 2012, some pressure, however, appeared, even though the current account posted a surplus in the first four months of FY13. 'In our view, this pressure can be traced to net outflows to the IFIs (around US$1.5 billion during Jul-Nov FY13). Although these payments do not impact the FX market directly, the drawdown of SBP's forex reserves has impacted market sentiments,' the report added.

In terms of tradeables, our export projections assume that cotton prices have bottomed-out, while Pakistan's low value-added textiles may be insulated from the demand contraction in the OECD, the Report said, adding that we do not expect any spike in imports given the sluggishness in domestic investment, and our view on global commodity prices. 'We also remain optimistic that inward remittances will continue to post strong growth,' the report said.

Pakistan is considered one of the best cement producers in the region, as its products are readily accepted in Middle Eastern countries, Africa as well as the neighbouring countries including India, Sri Lanka and Afghanistan, though the exports remained below the full potential mainly due to high transportation cost as most of cement units are located in nor..... Read more

Pakistan is considered one of the best cement producers in the region, as its products are readily accepted in Middle Eastern countries, Africa as well as the neighbouring countries including India, Sri Lanka and Afghanistan, though the exports remained below the full potential mainly due to high transportation cost as most of cement units are located in nor..... Read more

Noting with concern that electricity establishment led by the ministry of water and power has been maintaining the status quo for over two decades instead of steering the sector to reform, the power regulator has sided with the provinces’ view that they cannot contribute to electricity generation without the centre’s support.

Even with ..... Read more

Noting with concern that electricity establishment led by the ministry of water and power has been maintaining the status quo for over two decades instead of steering the sector to reform, the power regulator has sided with the provinces’ view that they cannot contribute to electricity generation without the centre’s support.

Even with ..... Read more

He government is considering banning incandescent bulbs and gas geysers in a phased manner to divert energy consumption from conventional sources to alternate sources and free up capacity in national electricity grid and gas transmission system for productive sectors.

A senior government official told Dawn on Monday that the federal government had f..... Read more

He government is considering banning incandescent bulbs and gas geysers in a phased manner to divert energy consumption from conventional sources to alternate sources and free up capacity in national electricity grid and gas transmission system for productive sectors.

A senior government official told Dawn on Monday that the federal government had f..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan