- Web

- Humsa

- Videos

- Forum

- Q2A

.jpg)

The National Electric Power Regulatory Authority (Nepra) has unearthed a rental power projects-like controversy, alleging that distribution companies of Wapda contracted for about 20 years over 135MW generation capacity without following rules and regulatory procedures.

About 10 captive power plants (CPPs) belonging to influential industrial groups in textile, cement and power sectors were contracted by three distribution companies of Wapda under a policy approved by the water and power ministry in 2009, according to eight separate orders issued by the power regulator and sent to the government.

Prime Minister Raja Pervez Ashraf was minister for water and power when the New Captive Power Policy was approved in 2009, which did not pass through the approval process of the federal cabinet or its economic coordination committee.

Interestingly, during the course of public hearing in the recent months, the current leadership at the water and power ministry led by Chaudhry Ahmad Mukhtar and Secretary Nargis Sethi did not fully own its previous policy and advised that scarce gas should be provided on a priority basis to efficient independent power plants (IPP) like Halmore, Orient and Saphhire which most of the time remained closed because of fuel shortage, instead of inefficient CPPs.

Nepra did not approve of gas-based electricity tariff for 10 CPPs approved by the distribution companies, Pakistan Electric Power Company (Pepco), Wapda and the water and power ministry. The average levelised tariff for the CPPs was about Rs6 per unit which at current gas price stands at about Rs9-10 per unit. The regulator was of the opinion that it should not be more than Rs5.20 per unit.

Under the policy, the distribution companies signed 20 years’ contracts with the CPPs for their surplus capacity. The Hyderabad Electric Supply Company signed agreements for 19MW electricity with Thatta Power, 13MW with Omni Power, 20MW with Lucky Cement, 10MW with Anoud Textile and 10.5MW with Khokhar Power.

The Sukkur Electric Supply Company signed agreements for 16MW electricity with Naudero Energy, 19MW with Dadu Energy and 16MW with Shikarpur Power. The Multan Electric Power signed an agreement for 10.5MW with Roomi Fabrics and the Faisalabad Electric Supply Company signed an agreement for 11.6Mw with Galaxy Textile.

Nepra said the New Captive Power Policy was formulated and approved by the board of directors of Pepco and endorsed by the water and power ministry for brand new thermal power plants by the industrial sector.

It said it had approved generation licences for the CPPs subject to condition that the exclusive responsibility of determining tariff, rates and charges under the Nepra Act would remain with the regulator. “The authority considers that prescribing tariff by the government or any of its agencies other than Nepra is inconsistent with sections 7(6) and 12 of the Nepra Act, and hence the approval of tariff by the distribution companies or Pepco’s board or its endorsement by the power ministry was without any

jurisdiction,” Nepra wrote in its orders.

Interestingly, Nepra has been allowing the tariff being paid to the CPPs through the consumer-end tariff until a year ago when the Supreme Court started hearing into the RPP case. Nepra discontinued payments to the CPPs through consumer-end tariff for three months and then allowed fuel cost to be built in the consumer tariff and disallowed financing cost and fixed charges.

Nepra said rules required the distribution companies to get the draft of power purchase agreement (PPA) with the CPPs scrutinised by the regulator before its formal signing with the CPPs, but this requirement was not complied with. It said the distribution companies did not approach the regulator for approval of its PPA under Nepra’s interim power procurement regulations of 2005.

Nepra said it was also a matter of record that the distribution companies did not even know the underlying assumptions/basis of the agreed (negotiated) tariff. “In view thereof the authority is constrained to construe that the consumers’ interest was not protected while agreeing different tariff components, particularly fuel cost component,” Nepra wrote.

It said the distribution companies had been asked to explain the basis of fuel cost to assess reasonability of its rates, but they had no information or basis of the tariff and terms and condition agreed in the PPA signed with the CPPs. The regulator said even the Central Power Purchase Agency (CPPA) – the umbrella organisation of distribution companies – did not have information about the actual thermal efficiency of the plants.

It said the CPPA claimed that heat rate and efficiencies of old and new plants had remained the same over the past 16 years even though a lot of improvements had been made in technologies and that tariff were negotiated without proper working and analysis. The CPPA’s response was “misconceived and misinterpreted” while “relevant laws, rules and regulations were not complied with”.

Nepra said the water and power ministry now conceded that the CPPs had low efficiency and argued that “utilisation of gas allocation may not be wasted on single cycle (of CPPs) of low efficiency rather it is advisable to use this pipeline quality gas to more efficient, bigger plants like Orient, Sapphire and Halmore”.

The rice exporters are eying to achieve $3 billion export target annually with the support of TDAP, as the authority’s role is vital to boost export and earn foreign exchange.Ch Samee Ullah, Vice Chairman REAP, hoped that TDAP will solve the problems instead for creating hurdles in the way of exports.

“We also hope that in future TDAP will si..... Read more

The rice exporters are eying to achieve $3 billion export target annually with the support of TDAP, as the authority’s role is vital to boost export and earn foreign exchange.Ch Samee Ullah, Vice Chairman REAP, hoped that TDAP will solve the problems instead for creating hurdles in the way of exports.

“We also hope that in future TDAP will si..... Read more

HONG KONG: Asian markets were mostly lower on Tuesday following a weak set of data out of the United States that added to recent concerns about the global economy.

The losses came despite a positive lead from Wall Street, which saw the downbeat US figures as a counterweight to talk that the Federal Reserve will start reeling in its monetary easing.

..... Read more

HONG KONG: Asian markets were mostly lower on Tuesday following a weak set of data out of the United States that added to recent concerns about the global economy.

The losses came despite a positive lead from Wall Street, which saw the downbeat US figures as a counterweight to talk that the Federal Reserve will start reeling in its monetary easing.

..... Read more

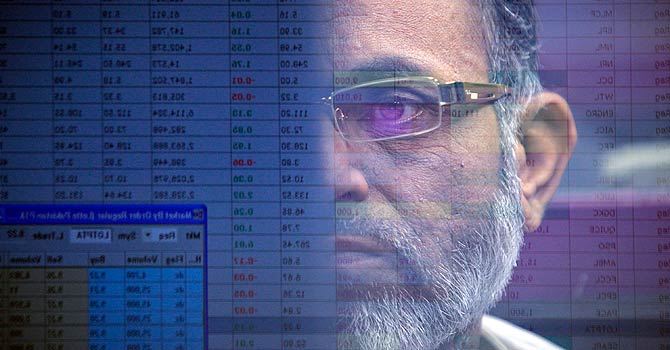

Pakistan’s stock market closed higher on Wednesday, led by Engro Corporation, Muslim Commercial Bank and cement companies, traders said.

Karachi Stock Exchange’s (KSE) benchmark 100-share index ended 0.34 percent, or 60.60 points, higher at 17,753.97 pointsEngro Corporation climbed 4.92 percent to 126.90 rupees and Muslim Commercial Bank Ltd..... Read more

Pakistan’s stock market closed higher on Wednesday, led by Engro Corporation, Muslim Commercial Bank and cement companies, traders said.

Karachi Stock Exchange’s (KSE) benchmark 100-share index ended 0.34 percent, or 60.60 points, higher at 17,753.97 pointsEngro Corporation climbed 4.92 percent to 126.90 rupees and Muslim Commercial Bank Ltd..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan