- Web

- Humsa

- Videos

- Forum

- Q2A

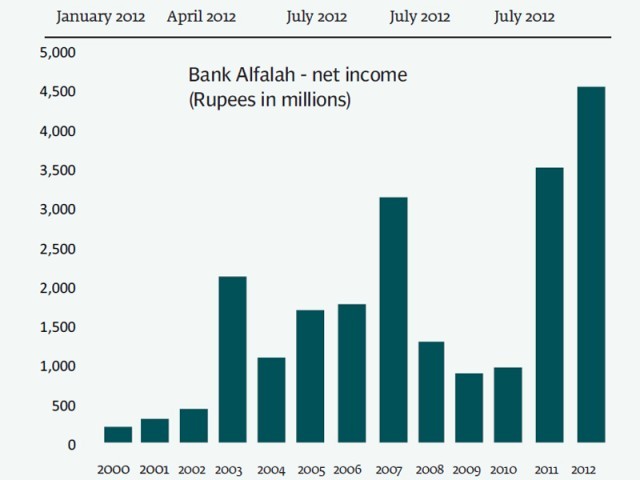

Bank Alfalah’s profit growth continued to impress, with the country’s sixth-largest bank announcing a 30% increase in profits for calendar year 2012; a feat made all the more remarkable by the fact that it had more than tripled its bottom-line in the preceding year.

The bank’s net income for 2012 was Rs4.6 billion, compared to Rs3.5 billion the previous year. “I am happy to report that our financial results for 2012 demonstrate the consistent efforts we are making to grow our balance sheet, diversify revenue streams, increase profitability and maintain a robust credit discipline by managing non-performing loans at a better rate vis-a-vis the market,” Bank Alfalah CEO Atif Bajwa said in a statement released to the press.

Yet, worryingly for the bank’s management, nearly all of that growth came from two sources: lower provisioning against bad loans, and a buoyant capital market that allowed the bank to sell stocks and government bonds for a much higher profit than last year.

Both factors that drove the bank’s profits up this year were borne of somewhat unique circumstances. The biggest cause – rising profits from equity and fixed income trading – came at a time when the stock market had one of its best years. And the State Bank of Pakistan vigorously cut interest rates in 2012, causing the prices of government bonds held by the bank to rise substantially, enabling the bank to profit by selling its bonds that had been issued at higher interest rates (interest rates and bond prices move in inverse correlation).

The second main driver of profits – lower provisioning against bad loans – was also the product of the fact that bad loans typically fall when interest rates start dropping. In addition, a much greater proportion of the bank’s lending in 2012 was to the government, which also lowers the overall level of bad loans. Most analysts now agree that interest rates in Pakistan have bottomed out and have nowhere to go but up.

The bank’s deposit base grew at par with the overall banking sector: up 13.9% to reach Rs457 billion compared to the overall 13.8% growth in the industry’s deposit base. Most of that growth came in the last quarter of the year.

Perhaps for this reason, the stock market reacted somewhat tepidly to the earnings announcement: Bank Alfalah stock rose by just 1.4% in trading on the Karachi Stock Exchange on Monday to close at Rs18.77 per share. Investors seem unsure of whether or not the bank’s new management will be able to continue its stellar growth spurt. The bank has also announced a dividend of Rs2 per share.

The year 2012 was the first one under the stewardship of the new CEO, who had previously been the CEO of MCB Bank. His predecessor – Sirajuddin Aziz – had stayed at the helm for over six years and had built the bank from a relatively small base into the sixth-largest bank in Pakistan. After his departure in late 2011, Atif Bajwa was recruited (after a brief stint at Soneri Bank) to help build up Bank Alfalah’s relationships with large corporate clients.

The last quarter of the year suggests that Bajwa’s reputation with respect to attracting deposits and growing a bank’s balance sheet is a well-deserved one: deposits grew by about 9% in just the last quarter of 2012.

How the bank grows in the coming year is an open question. Under Aziz, the bank’s strategy had been simple: keep expanding the branch network. Yet with 407 branches throughout Pakistan, that strategy may have limited room left. The bank also has a historical strength in consumer finance, though it has scaled back those operations since the financial crisis of 2008.

SINGAPORE: Oil prices slipped in Asia on Thursday after Federal Reserve chairman Ben Bernanke signalled the US central bank would wind down its stimulus programme later this year, analysts said.

New York's main contract, light sweet crude for delivery in July, was down 81 cents at $97.43 a barrel on its last day of trading, while Brent North Sea crud..... Read more

SINGAPORE: Oil prices slipped in Asia on Thursday after Federal Reserve chairman Ben Bernanke signalled the US central bank would wind down its stimulus programme later this year, analysts said.

New York's main contract, light sweet crude for delivery in July, was down 81 cents at $97.43 a barrel on its last day of trading, while Brent North Sea crud..... Read more

Oil prices were up in post-Christmas Asian trade Wednesday as traders warily eyed the soon-to-resume US budget talks on a deal to avert the fiscal cliff, analysts said.

New York's main contract, light sweet crude for delivery in February rose 46 cents to $89.07 a barrel and Brent North Sea crude for February gained 55 cents to $109.35.

..... Read more

Oil prices were up in post-Christmas Asian trade Wednesday as traders warily eyed the soon-to-resume US budget talks on a deal to avert the fiscal cliff, analysts said.

New York's main contract, light sweet crude for delivery in February rose 46 cents to $89.07 a barrel and Brent North Sea crude for February gained 55 cents to $109.35.

..... Read more

In the midst of a severe energy crisis, the water and power sector had been allocated a developmental budget of Rs103 billion for next year, which is 34% higher than the allocation for the current fiscal year, but still the ceiling fell short of expectations of executing agencies.

The combined budget offered to the Ministry of Water and Power and Water an..... Read more

In the midst of a severe energy crisis, the water and power sector had been allocated a developmental budget of Rs103 billion for next year, which is 34% higher than the allocation for the current fiscal year, but still the ceiling fell short of expectations of executing agencies.

The combined budget offered to the Ministry of Water and Power and Water an..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan