- Web

- Humsa

- Videos

- Forum

- Q2A

The Securities and Exchange Commission of Pakistan (SECP) has sought public opinion on the draft Issue of Commercial Papers Regulations, 2013, which are aimed at promoting corporate debt market and to facilitate corporate to raise fund from capital market through the issue of Commercial Papers (CPs).

CP is a short-term debt instrument normally issued by highly rated corporate to meet their short-term financial needs like working capital etc. A total of 33 CPs have been issued so far in aggregate amounting to Rs16 billion. These CPs were issued under the Guidelines for the Issue of Commercial Papers issued by the SECP on October 28, 2002. The CPs can be issued through private placement to persons mentioned in Section 120 of the Companies Ordinance, 1984, and notified there under or may be issued to the general public through prospectus.

In case of offer through private placement approval of the SECP is not required; however, in case of offer to the general public, the prospectus has to be approved by the SECP under Section 57 of the Ordinance before issue, circulation and publication.

The CP regulations stipulates the minimum conditions for issue of CPs, minimum and maximum maturity (between 30 to 365 days), size, denomination, mode and procedure for issue of CPs. The regulations allow an issuer to issue the CPs under the shelf registration process wherein an issuer can issue CPs in tranches over a period of time as soon as it needs fund provided that full Shelf Registration Plan is disseminated among the investors. Under the CP regulations an issuer may opt for early redemption or role-over of the issue but subject to the conditions set in the CP regulations.

The regulations also define the duties and responsibilities of the issuer, issuing and paying agent (IPA) and the credit rating company. The IPAs which may be a scheduled bank, an investment finance company or a development financial institution plays an important role in the issue of the CP. Its role includes adherence to the requirements of the CP Regulations by the issuer, marketing/placement/distribution of CPs, redemption of CP and reporting of the CP issue to the SECP.

The CP regulations will repeal the existing Guidelines for the Issue of Commercial Papers issued by the SECP on October 28, 2002. Comments/suggestions, if any, received from any person on the said draft CP Regulations within a period of 30 days of the publication of the same in the official gazette shall be taken into consideration by the SECP.In addition to its publication in the official gazette, the CP Regulations have also been placed on the SECP’s website for public comments.

In view of overwhelming demand from all districts of the four provinces and overseas Pakistani business community, the establishment of “All Pakistan Business Forum (APBF)” has been announced with its representation in all four provinces of Pakistan as well as Gilgit Baltistan and FATA. Business Forum of Punjab, an already existing entity working..... Read more

In view of overwhelming demand from all districts of the four provinces and overseas Pakistani business community, the establishment of “All Pakistan Business Forum (APBF)” has been announced with its representation in all four provinces of Pakistan as well as Gilgit Baltistan and FATA. Business Forum of Punjab, an already existing entity working..... Read more

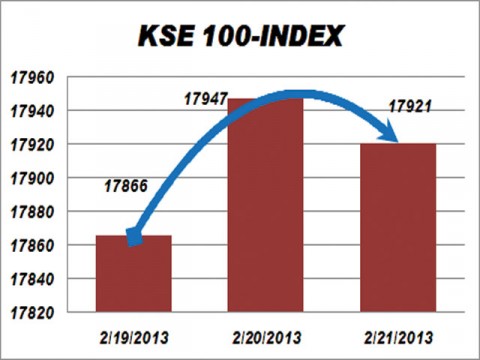

Stocks closed bearish with record trades on Thursday after fall in global stocks and commodities amid consolidation in blue chip stocks.

The benchmark KSE 100-share index shed 26.05 points or 0.15 per cent to end the day at 17921.02 points as compared to 17947.07 points of the previous day.Ahsan Mehanti, analyst at Arif Habib Corp, said index traded in na..... Read more

Stocks closed bearish with record trades on Thursday after fall in global stocks and commodities amid consolidation in blue chip stocks.

The benchmark KSE 100-share index shed 26.05 points or 0.15 per cent to end the day at 17921.02 points as compared to 17947.07 points of the previous day.Ahsan Mehanti, analyst at Arif Habib Corp, said index traded in na..... Read more

SINGAPORE: Oil prices were mixed in Asia on Thursday as traders took profits from gains fuelled by a bigger-than-expected drop in US crude inventories, analysts said.

New York's main contract, West Texas Intermediate (WTI) light sweet crude for delivery in August, was up 27 cents to $106.79 a barrel in afternoon trade after a dip earlier in the day..... Read more

SINGAPORE: Oil prices were mixed in Asia on Thursday as traders took profits from gains fuelled by a bigger-than-expected drop in US crude inventories, analysts said.

New York's main contract, West Texas Intermediate (WTI) light sweet crude for delivery in August, was up 27 cents to $106.79 a barrel in afternoon trade after a dip earlier in the day..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan