- Web

- Humsa

- Videos

- Forum

- Q2A

The industry on Thursday outrightly rejected the SROs 98, 140 and 154, and threatened to launch a series of mega protests allover the country, which will be backed by the exporters and manufacturers of Lahore, Sialkot, Faisalbad, Multan and Karachi if a forced implementation of widely-opposed and controversial SROs was made.

Sialkot Chamber of Commerce & Industry president Sheikh Abdul Majeed, while addressing a press conference, warned the government of countrywide agitation against discriminatory taxation which will stick up at least Rs.200 billion of only value-added textile sector in the form of refund claims.

Several industrial bodies’ representatives including PHMA chairman Rafi Soni, PRGMEA chief coordinator Ijaz Khokhar, Leather Garments Manufacturers Association chairman Zulfiqar Hayat, Surgical Instrument Association chairman Bilal Tanvir and Supports Goods Exporters Chairman Iqbal Saleemi also spoke on the occasion. Shaikh Majeed said that in first phase, from Friday the whole industry of the city will hoist black banners in their units to protest the controversial SROs.

He said that the FBR is duty-bound to safeguard the interests of all exporters and whenever and wherever they would oppose any FBR move, the SCCI would extend them every support. He said that the SCCI was unable to understand that why and at whose behest the FBR was implementing this widely opposed and controversial SROs 98, 140 and 145, which are unrealistic and unjustified.

He asked the Federal Board of Revenue to avoid issuing any such SRO without due consultation of industry and chambers in the country for being the main stakeholders.If the FBR was interested in broadening of tax net, it must impose GST at retail level, a practice which is done allover the world. He said that FBR is creating troubles for the registered persons who were already doing businesses in the presence of multiple internal and external challenges including energy crisis due to which 40 per cent export suffered.

PRGMEA chief coordinator and former chairman Ijaz Khokar said that SRO 154 is against WTO regime, which clearly states that exporters in every country are zero-rated.He said that the whole industry of the country is united against this SRO 154 and has unanimously declared that 2 per cent tax is unacceptable.

He complained that even today outstanding refunds of Rs60 billion are pending before different revenue collecting agencies at federal and provincial level.Meanwhile, the Pakistan Readymade Garments Manufacturers & Exporters Association on Thursday rejected sales tax regime for export-oriented industries under SRO 154.

PRGMEA central chairman Sajid Saleem Minhas, in a strong worded statement issued here on Thursday, asked the Lahore Chamber of Commerce & Industry and Federation of Chambers of Commerce & Industry’s regional office to stand up for the cause of industry. “It seems that they have abandoned the exporters in their hour of need.”

He said that majority of the woven and knitted garment industry comprises of SME’s, located in Punjab and Lahore, is the hub of this trade. He appealed to the LCCI leadership to call the meeting of all zero rated sector trade bodies in Lahore to understand the core issues involved in their stand against SRO 154.He said that the whole industry of Lahore is united against this SRO 154 and has unanimously declared that 2 per cent tax as unacceptable.

We need to understand the core issue. The FBR has recently stated in the press that the export is zero rated. It is indeed zero rated all over the world under international rules of avoiding double taxation among countries.The main problem is the fact that the exporters are the ones who will have to pay the tax to their suppliers and then stand in queue to collect their refunds.

This is the part that scares the exporters based on the horrible past experiences. In the past, the FBR thrice introduced refund system by withdrawing zero-rated status of export-oriented industry but failed because it ended up in resource drain more than revenue collection, he argued. To this day refunds from as far back as 2003/4 are stuck up in the system.

Further refunds for GST paid on packaging material has also reached a level where the burden is being felt as no refunds have come in for quite some time. Every time that we have gone into the refund system corrupt parties on both sides have manipulated the system and always caused a loss to the government and the exporters. The brunt of the sins of these corrupt parties was borne by the SME’s as their refunds were blocked, hence choking their liquidity and working capital.

Many had to resort to bank borrowing at exorbitant rates and as a result many had to close down. The exporters had breathed a sigh of relief when the zero rated regime was introduced.The zero rated regime allows the suppliers to direct exporters to supply goods at zero duty except for packaging material for which the exporter has to pay the GST.

.jpg) With a slew of social safety programmes ranging from food stamps for the poor to free medical coverage for the elderly introduced in most developed countries after World War II gradually becoming unsustainable in today’s ageing societies, many prosperous nations are now increasingly forced to cut down on their social-sector spending.

However, for a ..... Read more

With a slew of social safety programmes ranging from food stamps for the poor to free medical coverage for the elderly introduced in most developed countries after World War II gradually becoming unsustainable in today’s ageing societies, many prosperous nations are now increasingly forced to cut down on their social-sector spending.

However, for a ..... Read more

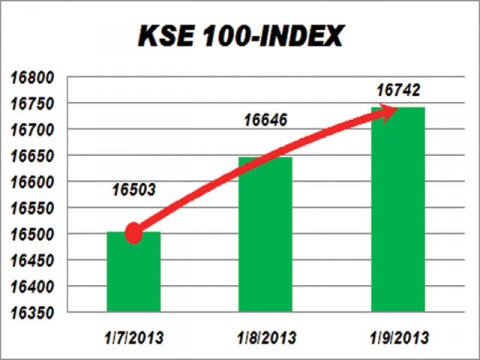

Cooling political temperature, hopes of better financial results and State Bank of Pakistan’s approval of AKBL transaction helped the stock market gain 96 points on Wednesday.

Market volumes remained low at 3 billion rupees. Major volume was seen in MLCF, AKBL and JSCL, stock dealer Muhammad Rizwan observed.At local equity market, the bench ma..... Read more

Cooling political temperature, hopes of better financial results and State Bank of Pakistan’s approval of AKBL transaction helped the stock market gain 96 points on Wednesday.

Market volumes remained low at 3 billion rupees. Major volume was seen in MLCF, AKBL and JSCL, stock dealer Muhammad Rizwan observed.At local equity market, the bench ma..... Read more

Pak Suzuki (PSMC) is expected to announce a price hike of around Rs20,000-25,000 per unit on Friday (today), showing an upward revision of 2-4 per cent, market sources said.

Industry expert Syed Atif Zafar said that PSMC had last raised its prices in October 2012 by a similar quantum. He stated that the price hike, if implemented, will be the first pric..... Read more

Pak Suzuki (PSMC) is expected to announce a price hike of around Rs20,000-25,000 per unit on Friday (today), showing an upward revision of 2-4 per cent, market sources said.

Industry expert Syed Atif Zafar said that PSMC had last raised its prices in October 2012 by a similar quantum. He stated that the price hike, if implemented, will be the first pric..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan