- Web

- Humsa

- Videos

- Forum

- Q2A

US stocks Monday finished lower as a partial US government shutdown entered its second week with no sign of resolution.

The Dow Jones Industrial Average fell 136.34 (0.90 percent) to 14,936.24.

The broad-based S&P 500 tumbled 14.38 (0.85 percent) to 1,676.12, while the tech-rich Nasdaq Composite Index gave up 37.37 (0.98 percent) at 3,770.38.

The paralysis in Washington continued to weigh on markets. Analysts have expressed particular concern that the fight over the budget will stymie efforts to raise the budget ceiling, resulting in a US default with damaging economic consequences.

However, the market still considers a US default unlikely, said Peter Cardillo, chief market economist at Rockwell Global Capital.

"If the markets were really fearful of a default.... we wouldn't be down a half a percent or three-quarters of a percent," Cardillo said. "We would be down a heck of a lot more."

Banking equities were among the hardest-hit. Dow component JPMorgan Chase fell 1.6 percent, Citigroup dropped 2.0 percent and Wells Fargo dipped 1.7 percent.

Dow component Boeing dropped 0.4 percent after Japan Airlines announced a massive $9.5 billion aircraft order with competitor Airbus. The decision challenged Boeing's dominance in the Japanese market.

Dow component IBM took a 1.1 percent hit after Barclays downgraded the stock to "equal weight" due to the lack of near-term catalysts for the stock.

Other technology companies also suffered, including Microsoft (down 1.7 percent), Amazon (down 2.8 percent), Priceline (down 1.9 percent) and eBay (down 1.8 percent). An exception was Apple, which advanced 1.0 percent after Jefferies upgraded the stock to "buy" following meetings with Asian suppliers who were enthusiastic about upcoming Apple products.

Cooper Tire & Rubber tumbled 12.8 percent as doubts rose over the prospects of a $2.5 billion takeover of the company by India's Apollo Tyres. Apollo has sought a reduction in the price of the transaction, but Cooper maintains no cut in price is warranted.

Defense contractor Lockheed Martin rose 0.9 percent after the company reduced the number of workers sent home without pay to 2,400 from 3,000 following the Pentagon's decision to recall most of its furloughed employees.

Bond prices rose. The yield on the 10-year US Treasury slipped to 2.63 percent from 2.65 percent Friday, while the yield on the 30-year Treasury dropped to 3.70 percent from 3.73 percent. Prices and yields move inversely. (AFP)

- See more at: http://www.geo.tv/article-121530-US-stocks-fall-as-budget-fight-continues--#sthash.L4sFgZpS.dpufUS stocks Monday finished lower as a partial US government shutdown entered its second week with no sign of resolution.

The Dow Jones Industrial Average fell 136.34 (0.90 percent) to 14,936.24.

The broad-based S&P 500 tumbled 14.38 (0.85 percent) to 1,676.12, while the tech-rich Nasdaq Composite Index gave up 37.37 (0.98 percent) at 3,770.38.

The paralysis in Washington continued to weigh on markets. Analysts have expressed particular concern that the fight over the budget will stymie efforts to raise the budget ceiling, resulting in a US default with damaging economic consequences.

However, the market still considers a US default unlikely, said Peter Cardillo, chief market economist at Rockwell Global Capital.

"If the markets were really fearful of a default.... we wouldn't be down a half a percent or three-quarters of a percent," Cardillo said. "We would be down a heck of a lot more."

Banking equities were among the hardest-hit. Dow component JPMorgan Chase fell 1.6 percent, Citigroup dropped 2.0 percent and Wells Fargo dipped 1.7 percent.

Dow component Boeing dropped 0.4 percent after Japan Airlines announced a massive $9.5 billion aircraft order with competitor Airbus. The decision challenged Boeing's dominance in the Japanese market.

Dow component IBM took a 1.1 percent hit after Barclays downgraded the stock to "equal weight" due to the lack of near-term catalysts for the stock.

Other technology companies also suffered, including Microsoft (down 1.7 percent), Amazon (down 2.8 percent), Priceline (down 1.9 percent) and eBay (down 1.8 percent). An exception was Apple, which advanced 1.0 percent after Jefferies upgraded the stock to "buy" following meetings with Asian suppliers who were enthusiastic about upcoming Apple products.

Cooper Tire & Rubber tumbled 12.8 percent as doubts rose over the prospects of a $2.5 billion takeover of the company by India's Apollo Tyres. Apollo has sought a reduction in the price of the transaction, but Cooper maintains no cut in price is warranted.

Defense contractor Lockheed Martin rose 0.9 percent after the company reduced the number of workers sent home without pay to 2,400 from 3,000 following the Pentagon's decision to recall most of its furloughed employees.

Bond prices rose. The yield on the 10-year US Treasury slipped to 2.63 percent from 2.65 percent Friday, while the yield on the 30-year Treasury dropped to 3.70 percent from 3.73 percent. Prices and yields move inversely. (AFP)

ISLAMABAD: Federal Minister for Finance, Senator Ishaq Dar Thursday said that Pakistan has submitted a formal application with the International Monetary Fund (IMF) for a loan program which the latter is expected approve by September 4.

“A formal request has been dispatched to IMF for the loan program and it is expected that the Fund will grant..... Read more

ISLAMABAD: Federal Minister for Finance, Senator Ishaq Dar Thursday said that Pakistan has submitted a formal application with the International Monetary Fund (IMF) for a loan program which the latter is expected approve by September 4.

“A formal request has been dispatched to IMF for the loan program and it is expected that the Fund will grant..... Read more

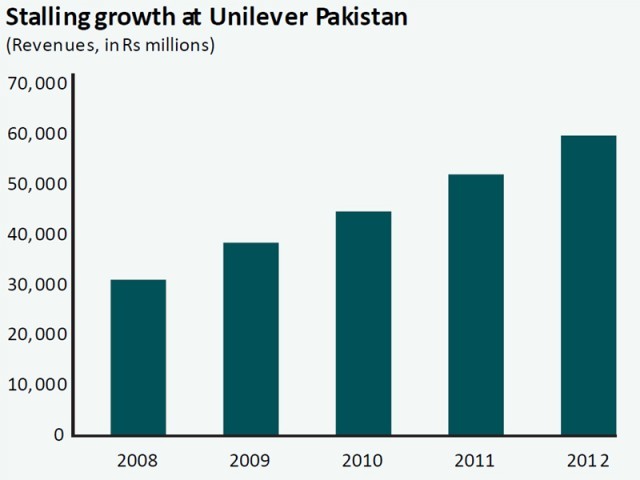

In what may be the first sign of a slowdown in at least some areas of consumer spending, Unilever Pakistan announced that its top line grew by about 15%, its slowest revenue growth in three years.

The company announced its financial results on Tuesday, and tried to put up a brave face on the results. Net revenue for the financial year ending December 31, ..... Read more

In what may be the first sign of a slowdown in at least some areas of consumer spending, Unilever Pakistan announced that its top line grew by about 15%, its slowest revenue growth in three years.

The company announced its financial results on Tuesday, and tried to put up a brave face on the results. Net revenue for the financial year ending December 31, ..... Read more

The Competition Commission of Pakistan’s report of January 2013, on automobile industry, has been termed as arbitrary, unfair and distressful for the automotive sector. This was stated in an official response to CCP by Abdul Waheed, Director General, Pakistan Automotive Manufacturers Association (PAMA).

While preparing the report CCP did not realiz..... Read more

The Competition Commission of Pakistan’s report of January 2013, on automobile industry, has been termed as arbitrary, unfair and distressful for the automotive sector. This was stated in an official response to CCP by Abdul Waheed, Director General, Pakistan Automotive Manufacturers Association (PAMA).

While preparing the report CCP did not realiz..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan