- Web

- Humsa

- Videos

- Forum

- Q2A

When the PPP-led government departs this weekend, energy crisis and high prices of oil and increases in gas and electricity tariff would be among the defining legacies of its five-year rule.

Despite difficult circumstances under which the PPP-led government had taken over, analysts point out that domestic factors and poor policies contributed greatly to oil price and tariff hike.They say poor policies and weak financial management affected all three sectors of energy — oil, electricity, and gas.

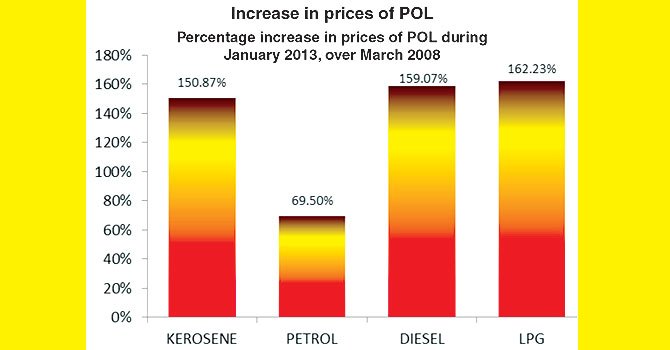

OIL: Prices of oil increase mainly because of the rise in international market, but, according to analysts, that is not the sole reason for 70 to 160 per cent hike in prices of petroleum products in retail market over the past five years. When the government took over in March 2008, the international oil price was about $120 per barrel. It now hovers around $123.9, an increase of 3.29 per cent.

Three factors were behind the phenomenal rise in prices of petroleum products for end-users — unprecedented declines in the value of the rupee, imposition of taxes and the levy of special tax on petroleum products to raise revenue.In March 2008, the US dollar fetched Rs62.6, but now it is worth 97.8 rupees. This has increased the cost of all imports.

Former economic adviser Dr Ashfaque Hasan Khan blames policies of former finance minister Shaukat Tarin for the steep decline in the value of Pakistani currency and the resultant inflation.According to the analysts, the government allowed depreciation of the rupee and did not take corrective measures.

In March 2008, the landed cost of oil was Rs8,029.5 per barrel which has now gone up by 51.1 per cent to Rs12,133.Higher oil prices led to higher collection of sales tax, from Rs134.73 billion in 2007-08 to Rs307.65 billion in 2011-12, an increase of 128 per cent.

A similar increase was recorded in collection of customs duties and withholding tax on petroleum products. But it was of no benefit to the federal government because the revenue transfer to the provinces under the divisible pool also increased under the 7th NFC Award. So the federal government increased the taxes on petrol to meet its rising expenses.

Federal expenses went up because the spending on defence and debt-servicing increased by 53.73pc and 39.39pc, respectively.Under the 18th Amendment, the provinces are not bound to share the burden of defence, debt and bailouts of public sector enterprises.

In 2009, the petroleum development levy was imposed on petroleum products also. The move brought the government Rs88.74 billion in 2009-10 and Rs57.6bn in the first six months of the current financial year and the figure may cross Rs100bn by June 30.Currently, consumers pay Rs103 for a litre of petrol, of which the government exchequer gets Rs28.5 in the shape of PDL, freight margin, dealer’s commission, distributor’s margin and general sales tax. In March 2008, petrol price was Rs61 and the PDL Rs10.76.

ELECTRICITY: Oil price hike affected the electricity tariff because many power plants use imported furnace oil to generate power.Since 2008 electricity tariff has been raised by 40pc to 94pc. The lowest rise of 40pc was for consumers using less than 50 units.The circular debt of the energy sector, which keeps the oil-based power plants running at much lower level, continues mounting.

A recent study of USAID estimated that the circular debt would reach Rs872bn by June 30. It was Rs326bn in March 2008.Since then the government has injected more than Rs1.5 trillion in the power sector.The electricity sector is facing three main problems – poor recovery of dues, tariff determination and passing of fuel adjustments. For the past eight months, the fuel adjustments were not passed on to end consumers. As a result, the government provided Rs3.15 per unit as subsidy.

GAS: Almost similar treatment was meted out to gas reserves. An increase of 20pc to 60pc was witnessed in the gas tariff in five years. The sector witnessed deterioration because of bad governance.Inefficiency in preventing gas theft and poor recovery remained the hallmark of the two government-owned gas companies and the burden is being passed on to consumers by increasing the tariff.

The fertilizer industry has been manipulated by only seven manufacturers, as they have abused their position by hiking urea rates by 88 per cent from Rs 850 to Rs 1,600 per bag unjustifiably on excuse of gas shortage despite the fact that gas suspension impacted just 25 per cent of the total urea manufacturing capacity.

Industry sources said t..... Read more

The fertilizer industry has been manipulated by only seven manufacturers, as they have abused their position by hiking urea rates by 88 per cent from Rs 850 to Rs 1,600 per bag unjustifiably on excuse of gas shortage despite the fact that gas suspension impacted just 25 per cent of the total urea manufacturing capacity.

Industry sources said t..... Read more

SINGAPORE: Oil prices climbed in Asian trade Monday after jobs data from the United States beat expectations, boosting confidence in the world's biggest economy.

New York's main contract, light sweet crude for delivery in August, gained

28 cents to $103.50 a barrel in morning trade and Brent North Sea crude for

August delivery added 25 cents to $107...... Read more

SINGAPORE: Oil prices climbed in Asian trade Monday after jobs data from the United States beat expectations, boosting confidence in the world's biggest economy.

New York's main contract, light sweet crude for delivery in August, gained

28 cents to $103.50 a barrel in morning trade and Brent North Sea crude for

August delivery added 25 cents to $107...... Read more

Oil-rich Abu Dhabi on Sunday officially opened the world's largest Concentrated Solar Power (CSP) plant, which cost $600m to build and will provide electricity to 20,000 homes.

The 100-megawatt Shams 1 is "the world's largest concentrated solar power plant in operation" said Sultan al-Jaber, the head of Abu Dhabi's Masdar, which oversees the emi..... Read more

Oil-rich Abu Dhabi on Sunday officially opened the world's largest Concentrated Solar Power (CSP) plant, which cost $600m to build and will provide electricity to 20,000 homes.

The 100-megawatt Shams 1 is "the world's largest concentrated solar power plant in operation" said Sultan al-Jaber, the head of Abu Dhabi's Masdar, which oversees the emi..... Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan