- Web

- Humsa

- Videos

- Forum

- Q2A

During 2012, circular debt, energy shortages, security situation, fiscal deficit and IMF repayments on one hand kept investors on their toes while on the other hand lower inflation, monetary easing and resolution of capital gains tax issue led the market to see higher highs.

Experts said that in spite of economic woes, heightened security environment and power crisis, KSE (100-index) has been one of the best performing markets in the world. Pakistan posted a gain of 49 per cent in local currency and 38 per cent in US dollar in 2012. However, the rupee lost its strength against dollar by 8 per cent, as the greenback improved by Rs7.20 in one year.

Quoting the Bloomberg, experts from Topline Securities observed that Pakistan ranked amongst top 10 in the world. Main reason was 450bps decline in policy rate in last 18 months that besides boosting earnings, encouraged funds flows from government securities to equities. Resolution of Capital Gains Tax issue, improved relationship with US, better foreign flows and serenity on the political canvas were amongst other factors that created positive sentiments in the market.

Overall, average daily volumes improved to 173 million shares during 2012 as compared to 79 million shares in 2011, while in value terms they stood at Rs4.7 billion or $50 million as against Rs 3.5 billion or $40 million in 2011. However, it compares unfavorably with last 10-year average daily volume of 220 million shares (Rs16 billion or $237 million).

Noted economist Muhammad Sohail pointed out in a note that though, capital gain reforms were the headline stories in the initial part of the year, but major impetus to the market has come from substantial reduction in the interest rate in last 18 months. Since July 2011, policy-markers had reduced the discount rate by 450bps to 6.5-year low to 9.5 per cent amid considerable reduction in the inflation numbers (November CPI 6.9 per cent is record low) that allowed them to focus on revival of growth. This not only improved the operating dynamics of leverage companies namely cement and textile, but has also accommodated funds flows from debt securities to stock market.

Foreigners, that hold $3.1 billion worth of Pakistan shares which is 30 per cent of free-float (7 per cent of market cap), remained net buyers in 2012, despite perception of heightened security concerns and structural issues. Foreigners in 2012 bought shares worth $933 million and sold $808 million, resulting in net buying of $125 million ($194 million excluding Hubco). Though the number is a considerable improved from last year net sell of $127 million, but in regional perceptive the number is still subdued as seen from the accompanying table.

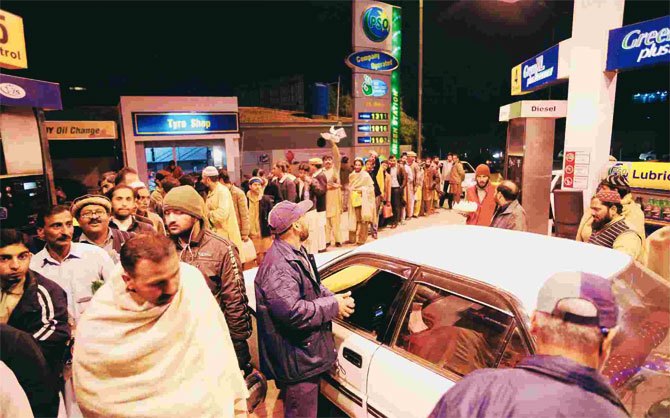

Like a large number of motorists, Tariq Mehmood was fearful, tense and distressed while driving towards his office in Islamabad from Rawalpindi Monday morning.

He was in the predicament not because of any insecurity or due to the fear of any natural calamity.His main concern was the almost empty petrol tank of his car and the long..... Read more

Like a large number of motorists, Tariq Mehmood was fearful, tense and distressed while driving towards his office in Islamabad from Rawalpindi Monday morning.

He was in the predicament not because of any insecurity or due to the fear of any natural calamity.His main concern was the almost empty petrol tank of his car and the long..... Read more

After its emergent session presided over by Agha Saiddain Central Chairman Pakistan Tanners’ Association (PTA), the Association appealed to Mian Shahbaz Sharif, Chief Minister of Punjab, to take immediate note on the orders notified by DCO for closure of every kind of leather hide and skin business within the limits of Municipal Corporation limits ..... Read more

After its emergent session presided over by Agha Saiddain Central Chairman Pakistan Tanners’ Association (PTA), the Association appealed to Mian Shahbaz Sharif, Chief Minister of Punjab, to take immediate note on the orders notified by DCO for closure of every kind of leather hide and skin business within the limits of Municipal Corporation limits ..... Read more

Governor State Bank of Pakistan (SBP) Yaseen Anwar will announce Monetary Policy Statement on Feb 8, said the central bank’s spokesman here Wednesday.

Read more

Governor State Bank of Pakistan (SBP) Yaseen Anwar will announce Monetary Policy Statement on Feb 8, said the central bank’s spokesman here Wednesday.

Read more

Clean Chit (Faisal Raza Abidi ...

Clean Chit (Faisal Raza Abidi ...  Akhir Kiyon - 16th December 2...

Akhir Kiyon - 16th December 2...  To The Point - 16th December ...

To The Point - 16th December ...  Capital Talk â

Capital Talk â  Kal Tak - 16th December 2013

Kal Tak - 16th December 2013  Bay Laag - 16th December 2013

Bay Laag - 16th December 2013  Kharra Sach - 16th December 2...

Kharra Sach - 16th December 2...  Awaam - 15th December 2013

Awaam - 15th December 2013

Gold Miner

Gold Miner  Superbike GP

Superbike GP  Whipsaw Fighter

Whipsaw Fighter  PacMan

PacMan